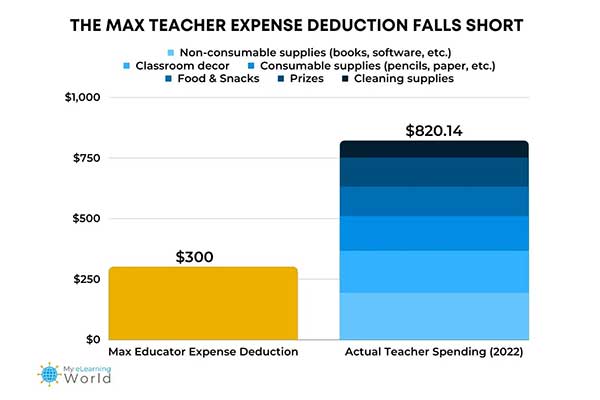

With Teacher Appreciation Week coming up in May and today being the last day to file taxes, many teachers may be lamenting the fact that they cannot deduct all the expenses they incur running their classrooms. According to a study by myelearningworld, teachers spend 3 times more on their classrooms than they can deduct on their taxes.

Some key takeaways from the study include:

- The typical teacher spent an average of $820.14 out of pocket on school supplies in 2022 — the largest amount ever.

- In all, teachers across the US spent an estimated $3 billion on essential items to help their students succeed, like pencils, paper, cleaning supplies, books, software, and other materials.

- The educator expense deduction was enacted just over 20 years ago in 2002, giving teachers the ability to deduct up to $250 of out-of-pocket classroom expenses when filing their federal tax returns.

- For the 2022 tax year being filed now, the maximum deduction has only increased ever so slightly to just $300.

- If the maximum educator expense education had kept pace with inflation since its passing in 2002, teachers would be able to deduct over $400 in expenses, but that’s not the case.

Here’s the full link to the study: https://myelearningworld.com/teacher-tax-report-2023/